All grades play 6v6 volleyball.

Practices begin in mid-January and the season runs through early April.

All practices are held at the Mother Brunner Gym.

Games are held on weeknights, Saturdays, and Sunday afternoons.

All volleyball players will be provided a jersey, which they will return at the end of the season. Volleyball players must provide their own black shorts, knee pads, and athletic shoes.

Please note: Students may be placed in a division other than their registered grade based on team size and skill level.

Register Here

Thank you again for your support!

Consent forms have been sent home. If you’d like your child to participate, please complete and return the paper form. Alternatively, you can sign up quickly and easily online using this link:

https://www.myschooldentist.com/MBOTOH_sch

We encourage families to use either method—paper or online—to ensure your child is included in this valuable opportunity.

Thank you for helping us support your child’s health and well-being!

These items cannot be stored and MUST be picked up during this time. Please COME TO THE GYM between 3:45-6 pm on Thursday, November 13.

If you have any concerns, please contact the school office at 937-277-2291.

Thank you again for your support!

We’re hosting a Double Good Popcorn Fundraiser, and we’d love your help! 🍿

This is a 100% virtual fundraiser running Oct 23 at 5:00 pm through Oct 27. Order some delicious popcorn, and a portion of every purchase goes directly toward supporting Brunner Bulldogs Athletics 💙

Please help us reach our goal and enjoy some amazing snacks while you’re at it!

📣 Support here: https://popup.doublegood.com/s/y7z1um76

(If the link doesn’t work for you, please let us know!)

Thank you for cheering on our Bulldogs! 🐶💪

It’s that festive time of year again, when creativity, fun, and a little friendly competition take over our hallways! Our staff members are busy transforming ordinary pumpkins into incredible works of art for our annual Pumpkin Decorating Contest and Student Raffle.

Each teacher or staff member is decorating a pumpkin that will soon be raffled off to our students. From spooky to silly, painted to carved, you’ll see a wide variety of creative pumpkins on display throughout the school hallways.

Judging and Voting:

Students and parish staff will have the chance to tour the pumpkin displays and vote for their favorites from October 13–22. Winners will be announced on Wednesday, October 22, at 2:00 pm.

Every class will receive tickets to cast votes for their favorite pumpkins, and the lucky winners of the pumpkin raffle will get to take one home!

We can’t wait to see the creativity our staff brings to this fun Halloween tradition.

Happy Halloween!

Parents who are not skating do not have to pay. Thank you for your support!

Join the 2025–2026 basketball season for students in grades 3–8! The program is open to all who attend St. Rita, St. Paul, Precious Blood parishes, and Mother Brunner Catholic School. The cost is $100, and registration closes on October 30, 2025, at 10:00 PM. The season will run from October 31, 2025, through February 1, 2026.

To register you will need to follow the link below, create a user ID and follow the prompts. Call the school office if you have any questions 937-277-2291.

Coaches are very important to the success of our program. Coaches will run weekday practices after school and be present at all games. SafeParish Certification is required.

Contact the Athletic Director Jonathan Bibbs for more information: jbibbs@brunnercatholicschool.org.

Basketball Registration: https://tshq.bluesombrero.com/Default.aspx?tabid=2734529

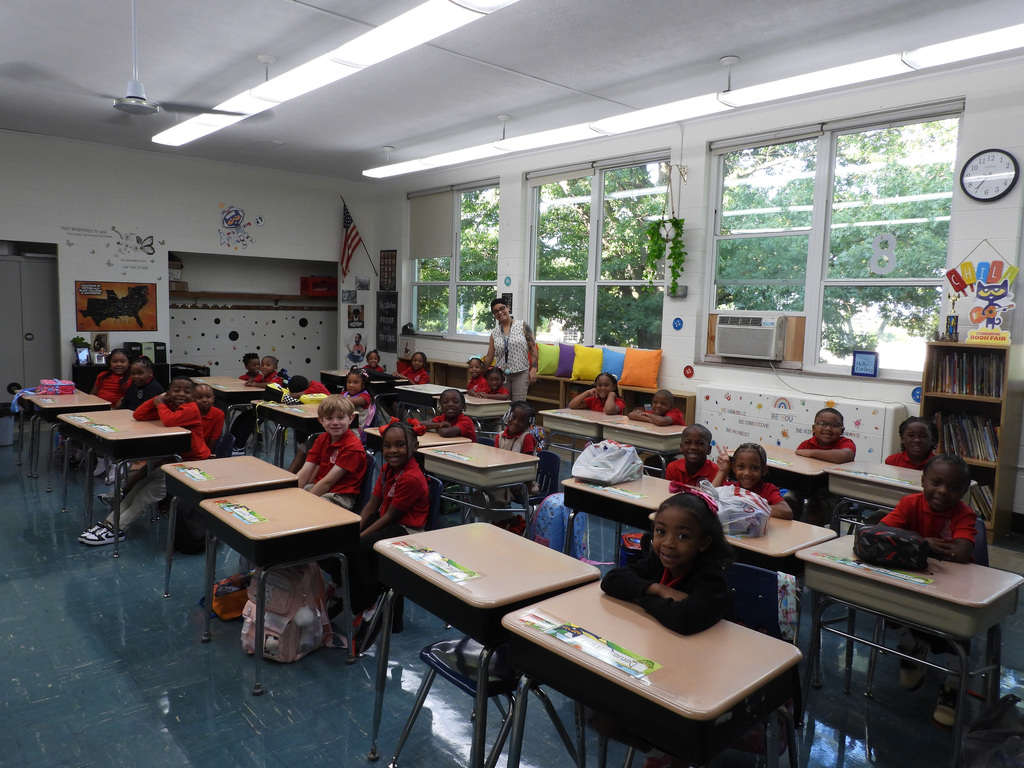

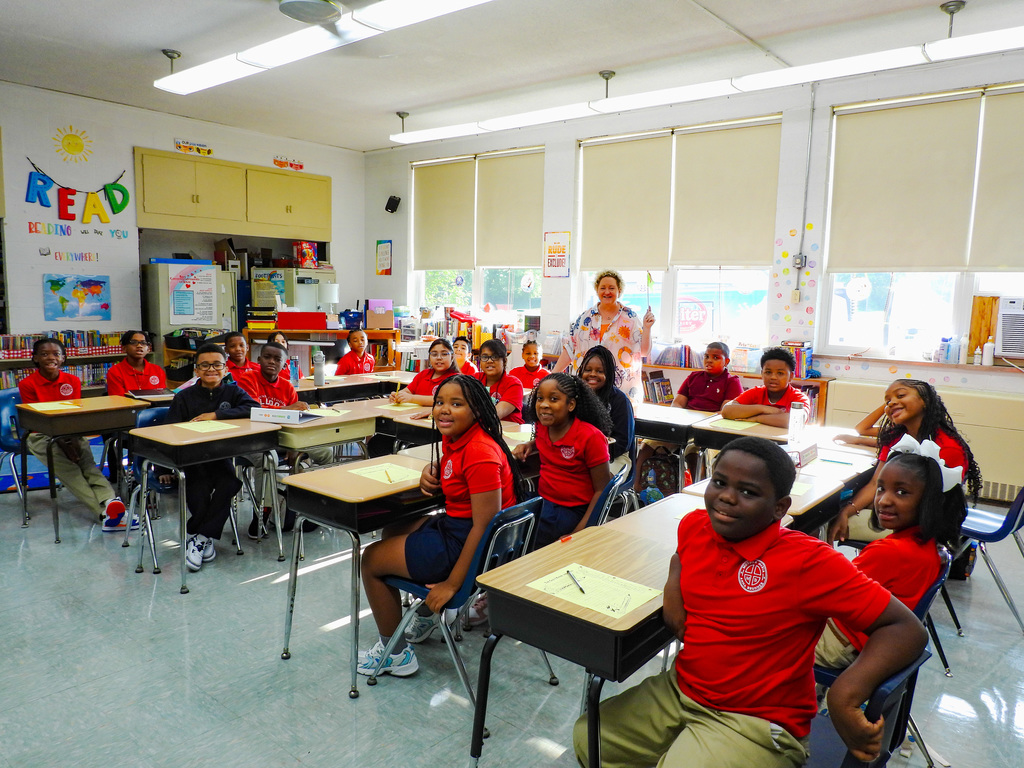

Packets with ordering information will be sent home soon. These packets will give you all the details you need to place your order and select the photo package that works best for your family.

Thank you for your support—we look forward to capturing wonderful memories of our students on Picture Day!

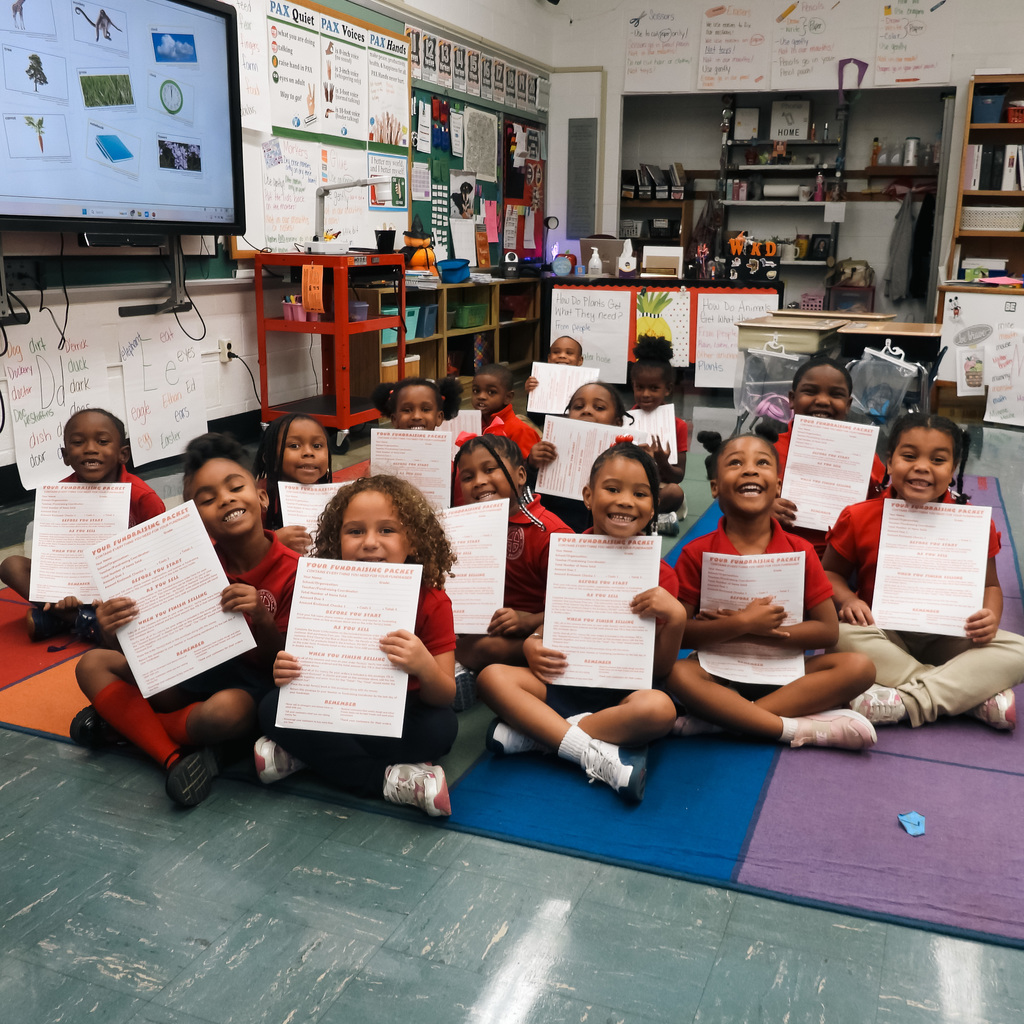

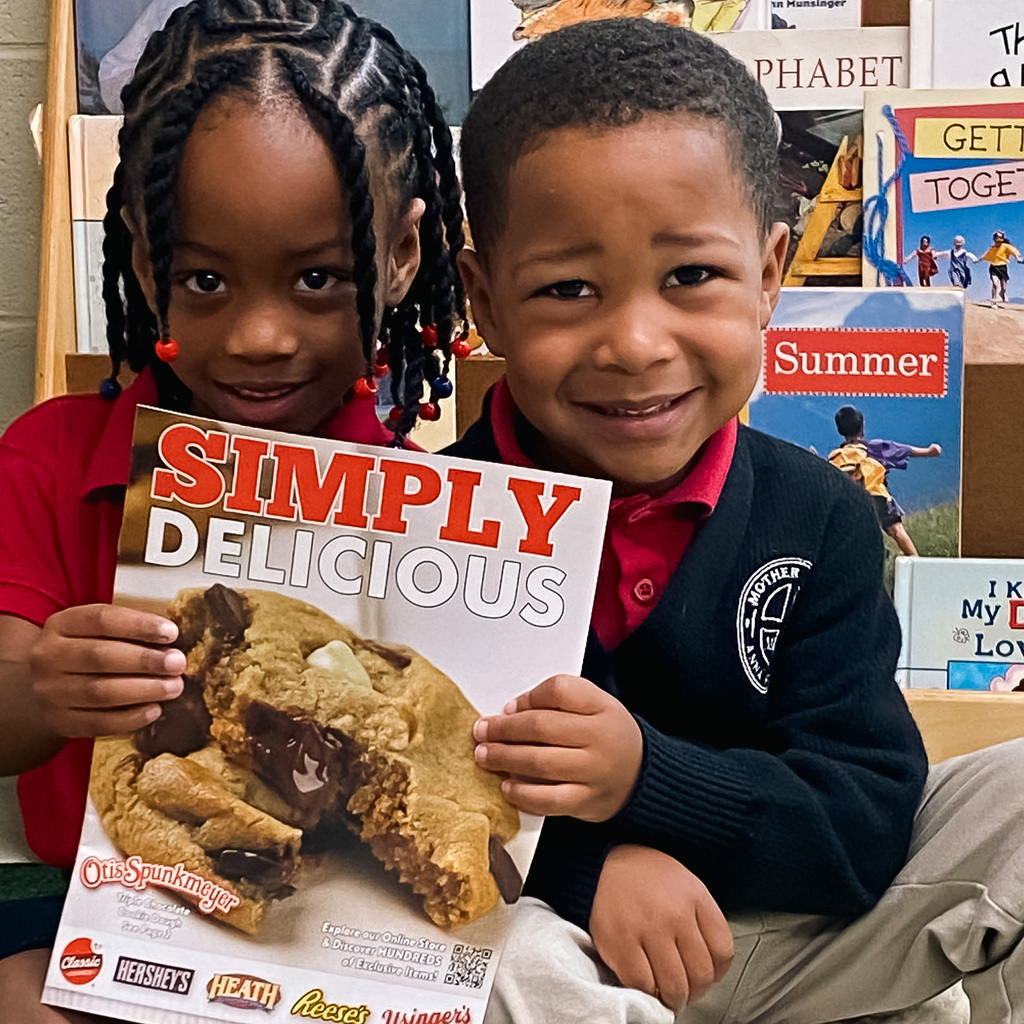

Today, we launched our Otis Spunkmeyer Fundraiser with a fun all-school assembly! Otis Spunkmeyer is famous for its delicious cookie dough, and students brought home their order forms today. Please follow the instructions on the form to set up your child’s online store—it’s quick, easy, and an excellent way for family & friends (even out-of-town!) to support.

There is also an order form included in your student's packet that you can share with family and friends.

To shop online, use our Group ID#WF876 and visit: needsyoursupport.org.

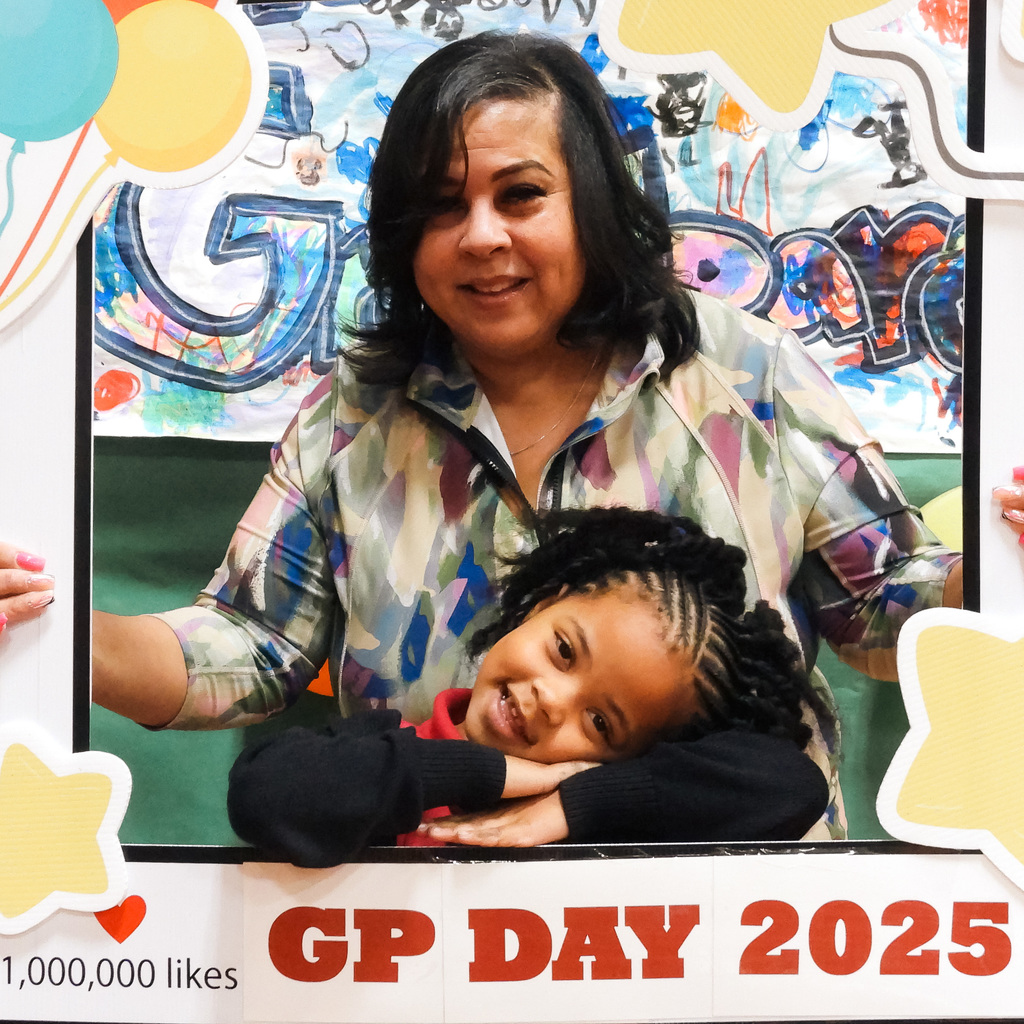

Thank you to all the grandparents who came out to spend time, share stories, and create lasting memories. Your presence truly filled our school with love, laughter, and wisdom.

We’d also like to give a heartfelt thank you to our dedicated staff, whose hard work and care made this day such a wonderful success.

Be sure to check out the photos from today’s celebration—we captured so many beautiful moments of hugs, smiles, and togetherness. Find all of the photos here:

https://photos.app.goo.gl/iNqNZoDte1eSbNJB9

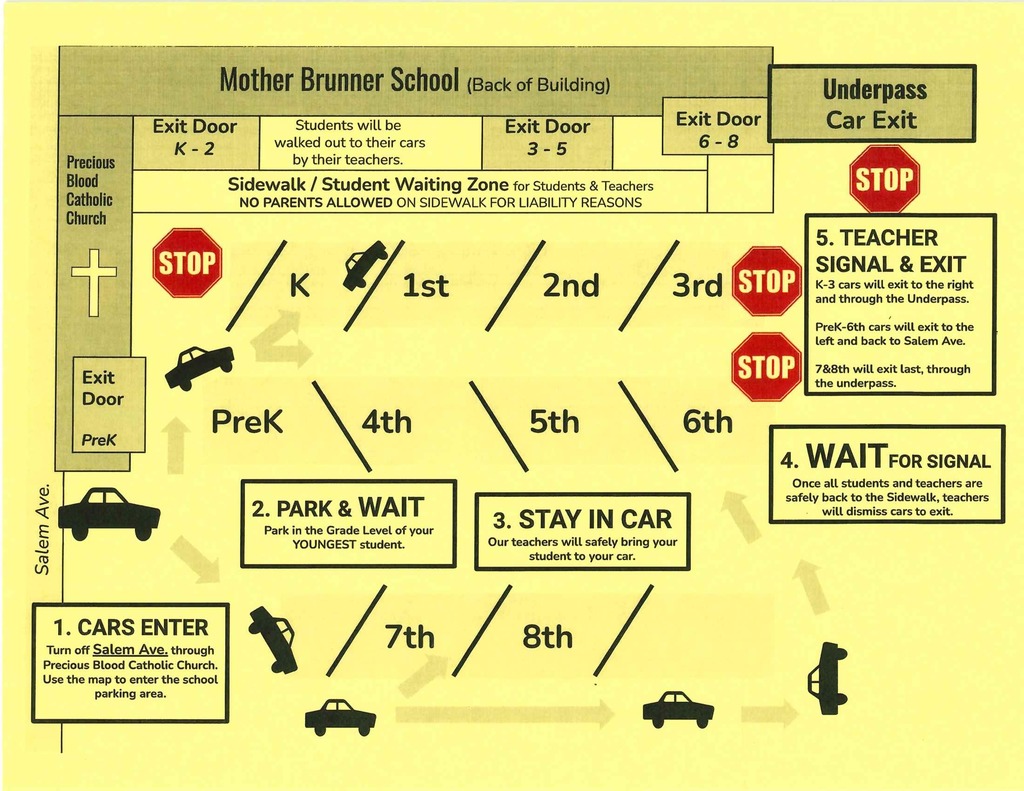

Please park in the front or back by the underpass and enter through the gym door. Lunch will be served in the gym.

Pre-K, K 10:35-11:05am

1st, 2nd, 3rd 10:50-11:40am

4th, 5th, 6th 11:25am-12:15pm

7th, 8th 12:20-1:05pm

At Mother Maria Anna Brunner Catholic School, we know how important it is for parents to stay informed about what’s for lunch. That’s why we've set up a convenient Lunch Menu Hub to keep families in the loop—fresh menus posted throughout the year, all in one easy-to-access spot

https://core-docs.s3.us-east-1.amazonaws.com/documents/asset/uploaded_file/2935/MMAB/5909889/LunchMenu25-26.pdf

The lunch menu is out!

View the menu for the year here:

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://core-docs.s3.us-east-1.amazonaws.com/documents/asset/uploaded_file/2935/MMAB/5909889/LunchMenu25-26.pdf

6 things to know about Ohio’s sales tax holiday, which starts next week

VISIT THE STATE WEBSITE FOR ALL OF THE DETAILS

Ohio’s upcoming sales tax holiday continues to grow the ways people can save and, this year, the amount of days in which they can do it. The tax holiday, which starts next week and lasts 14 days, is designed to provide “meaningful savings for families across the state,” Gov. Mike DeWine said previously. Saving money during the sales tax holiday takes more than just circling dates on a calendar and filling your cart. For those seeking to cut costs, here are some key considerations to maximize this limited-time opportunity.

The sales tax holiday has expanded.

Instead of 10 days like last year (or a single weekend, as it was in previous years, this year’s sales tax holiday spans two weeks. It kicks off at midnight on August 1 and ends at 11:59 p.m. on August 14.

“The timing of this year’s sales tax holiday not only supports families preparing for back-to-school, but also provides relief on other important household needs,” DeWine said in a statement.

Shopping during the sales tax holiday expanded last year’s so that it is no longer limited to clothing and to back-to-school supplies, and allows for greater spending. Ohio last year allowed the purchase of almost all tangible personal property priced at $500 or less per item to be made tax-free. That replaced the state’s previous limits of $20 for school supplies per item and $75 for clothing per item.

The holiday extends beyond brick-and-mortar stores For someone looking to score as many deals as possible. Still, wanting to save time and avoid the crowds, this year’s installment will allow shoppers to make qualifying purchases both in-store and online without paying state sales tax.

The fine print to keep in mind is that online purchases must be made within the designated time frame — before the Aug. 14 deadline — and shipped to a qualifying address.

Amazon and its partner sellers honor the holiday, so eligible purchases won’t be taxed as long as an order meets the rules. Keep in mind, though, that some items may still be taxed if they don’t qualify — like product bundles, orders placed before the tax holiday starts and items that exceed price limitations.

Location does matter

If you buy from an online seller during the sales tax holiday, the seller’s time zone decides whether the purchase qualifies. So if it’s 1 a.m. Friday in your time zone but still 10 p.m. Thursday where the seller is — like Pacific Time — the holiday hasn’t started for them yet, and sales tax still applies.